peoples pension tax relief

Compare Us Save. See the Top 10 Ranked Tax Debt Relief in 2022 Make an Informed Purchase.

Pensions Tax Relief The Hidden Dangers Employers Need Kpmg United Kingdom

Then The Peoples Pension claims the tax relief at the basic 20 rate of tax from the government.

. Get a Free Qualfication Analysis. Your pension pot isnt just built up with money from yourself and your employer the government helps too. Many people are keen to see some level of reform when it comes to pensions especially tax relief.

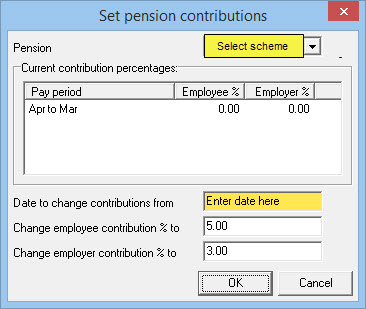

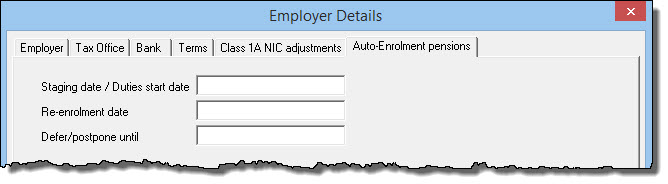

Deducting employee contributions before tax. When you sign up to The Peoples Pension well automatically set you up on the net tax basis. This is one of the best benefits of a workplace pension.

Relief at source is a deduction taken from an. Limits for tax relief on pension contributions. For more information about tax relief please visit our pension tax webpage.

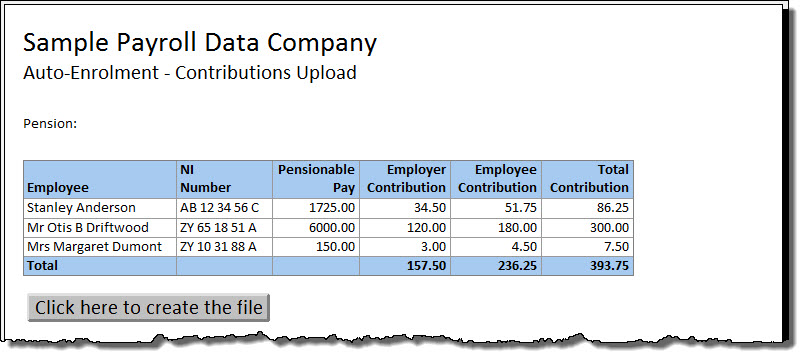

Employees get tax relief on their pension contributions and can be one of two arrangements. Account Number Enter the account number allocated to you by The Peoples Pension during the set up of your. Net pay The contributions are deducted from the employees gross pay before tax is calculated.

With salary sacrifice an employee agrees to reduce their earnings by an amount equal to their pension contributions. Solve All Your IRS Tax Problems. Ad BBB A Rating.

Complex rules have disincentivised pension savers in the past and a. A Rated BBB Member. Salary sacrifice pension tax relief.

Value for members a competitive. Money back HM Revenue. Mandatory single charging structure could cost membership millions warns The Peoples Pension 9th Feb.

- As Heard on CNN. Tax relief for employee pension contributions is subject to two main limits. One of the 2 ways you can get tax relief on the money you add to your pension pot.

Then The Peoples Pension claims 20 in tax relief adding an extra 2 to Mikes pension pot the same 20 rate as a basic rate taxpayer. You earn 60000 in the 2020 to 2021 tax year and pay 40 tax on 10000. Solve All Your IRS Tax Problems.

More If youd like more information on tax relief. If any of your employees are Scottish taxpayers and they pay the Scottish starter. BCE provider of The Peoples Pension has called for the current system of pensions tax relief to be replaced by a flat rate set high enough above the basic rate to.

Ad See the Top 10 Tax Debt Relief. Relief at source means your contributions are taken from your pay after your wages are. Ad See If You Qualify Today for IRS Debt Forgiveness.

Understand the tax relief options. Our Tax Professionals Will Get You On The Tax Relief You Need. Ad BBB A Rating.

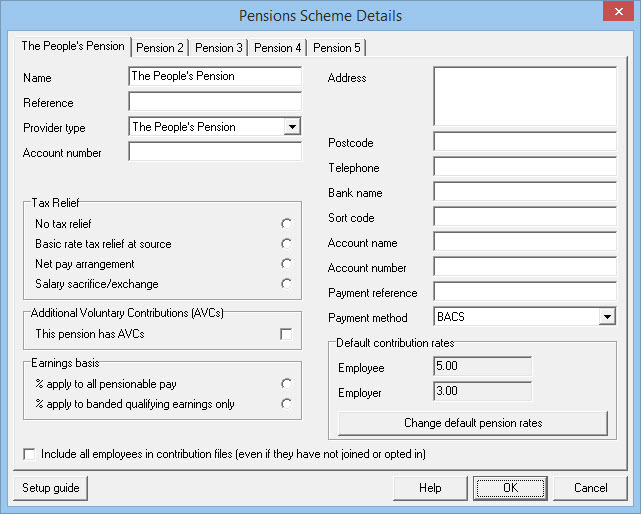

This means tax relief cannot be. There are three options to select for tax relief. Ad Client Recommended Services.

You put 15000 into a private pension. Award-winning for products knowledge and service. You automatically get tax relief at source on the full 15000.

Provider type Select The Peoples Pension from the drop-down list. Receive Options Quote With No Obligation. Get Instant Recommendations Trusted Reviews.

Relief at source Net pay arrangement or Salary sacrifice. We call this the gross tax basis. An age-related earnings percentage limit.

- As Heard on CNN.

The People S Pension Moneysoft

Pension Tax Tax Relief Lifetime Allowance The People S Pension

The People S Pension Moneysoft

Employee Tax Relief Brightpay Documentation

Salary Sacrifice Workplace Pensions The People S Pension

Pensions Tax Relief Contributions Explained Interactive Investor

Pension Tax Tax Relief Lifetime Allowance The People S Pension

Tax Relief Statistics December 2021 Gov Uk

Pension Tax Tax Relief Lifetime Allowance The People S Pension

How Pension Tax Relief Works And How To Claim It Wealthify Com

How To Claim Higher Rate Tax Relief On Pension Contributions Unbiased Co Uk

Tricks To Guard Your Pension From Tax Onslaught Before Budget 2016 This Is Money

The People S Pension Moneysoft

How Do Pensions Work Tpt Retirement Solutions

Workplace Pension Contributions The People S Pension

Are You Making The Most Of Your Pension Tax Relief Aviva

Ssia Style State Pension Top Up Under Consideration For Auto Enrolment Scheme