ebike tax credit income limit

This means that the federal government has not finalized it. VanMoof e-bikes displayed at the company.

Ebike News E Bike Tax Credits Back On Track New Schwinn And Gazelle E Bikes And Much More Electric Bike Report Electric Bike Ebikes Electric Bicycles E Bike Reviews

Joint filers who make up to 150000 can qualify for two bikes and up to a 900 tax credit on each.

. Individuals who make 75000 or less qualify for the maximum credit of up to 900. Cars need to be under 55000. The halving of the incentive is sadly not the only revision reports Electrek.

Goals of the E-Bike Affordability Program. A proposed tax credit against the purchase of an e-Bike in the USA has made progress in Congress but those eagerly awaiting a saving of nearly a third will be left reeling at the news the discount will now be no more than 15. 7500 for the electric vehicle an additional 2500 for vehicles assembled within the United States and.

USAs e-Bike tax credit moves along but is halved. Theres also an income limit for taxpayers to receive the credit. Prioritize grants to individuals from low-income households.

For those who make less than 75000 as an individual or 150000 as joint. They are a legitimate and practical form of transportation that can help reduce our carbon. Theyre Subject To ChangeThe value of the tax incentives is subject to change by lawmakers over time so make sure you understand what your e-bike is worth before applying for a tax incentive.

16 September 2021 Mark Sutton. According to the federal standards the law only applies to bicycles that are 750 watts. However the bill is nothing that is set in stone and is a proposed one.

500000 for married couples. The Electric Bicycle Incentive Kickstart for the Environment Act creates a consumer tax credit that can cover up to 30 of the cost of buying an eBike. It only applies to new e-bikes that cost less than 8000 and is fully refundable allowing lower-income workers to claim the credit.

Today the electric car tax credit provides a dollar-for-dollar reduction to your income tax bill. Individuals may claim the credit for one electric bicycle per year max 750 credit or two bikes for joint filers max 1500 credit. At of 10-28-21 the tax credit plan under consideration is.

This could show up as part of your refund or as a reduction of the amount of taxes you would otherwise pay. 30 5000 bike price limit. The credit phases out starting at 75000 of modified adjusted gross income 112500 for heads of household and 150000 for married filing jointly at a rate of 200 per 1000 of additional.

E-bikes are not just a fad for a select few. Spending bill is a tax credit of up to 900 for electric bicycles. The proposed eligibility requirements for the EV tax credit are simple.

E-Bike Sales Could Get Big Push From Build Back Better Act Tucked among the massive US. Define eligibility for the program as individuals and households with incomes below the maximum. If you wish to splash 10000 dollars on an E-bike then you may not even need a tax deduction.

Based on battery capacity you could receive a tax credit of up to 7500. All-electric and plug-in hybrid vehicles bought new in or after 2010 may be eligible for a 7500 federal income tax credit. The proposed tax credit would not apply to any e-bike worth more than 8000.

The E-BIKE Act creates a consumer tax credit that will cover 30 of the cost of the e-bike up to a 1500 credit. The legislation would offer Americans a refundable tax credit worth 30 percent of a new e-bikes purchase price capped at 1500. The new proposal limits the full EV tax credit for individual taxpayers reporting adjusted gross incomes of 250000 or 500000 for joint filers down from 400000 for individual filers and.

83k for individual or households over 158k. DavidZipper reports the sausage making is still underway with the House Rules Committee having now cut the max value of the proposed tax credit to 900 the max price of an eligible ebike to 4000 and individuals must make less. The credit would offer certain citizens a 30 percent refundable tax credit if they purchased an e-bike under 4000.

In the updated bill a 15 tax credit would be available for the purchase of an e-bike up to 5000 meaning a maximum credit of 750. The amount of the credit will vary depending on the capacity of the battery used to power the car. The credit begins to phase out above those income levels at a rate of 200 per 1000 of additional income.

The credit has a limit of 1500 or 30 of the total cost whichever is less. Congressmen Propose 30 Percent Income Tax Credit For The Purchase Of An Electric Bike. The e-bike tax credit would phase out at 75000 adjusted gross income for individual taxpayers 112500 for heads of household and 150000 for married filing jointly.

There now also exists an income based phase out of the credit applicable to those earning over 70000 or 112500 for heads of household and 150000 if the submission is made on behalf of married couples. Annual limits usually range from 20-30 million dollars per state for most incentives meaning not every person who applies will be approved. The full 12500 would be earned in increments.

250000 for single people. 2 That means that a 7500 tax credit would save you 7500 in taxes. Help people replace car trips with e-bike trips.

Non-cars vans trucks SUVs need to be under 80000 to be eligible for the credit. Supporters who have followed the E-BIKE Act since it was introduced in February will notice that these differences shrink the.

Tax Credits Jump To 1 500 For E Bikes 7 500 For Electric Motorcycles In Build Back Better Act R Motorcycles

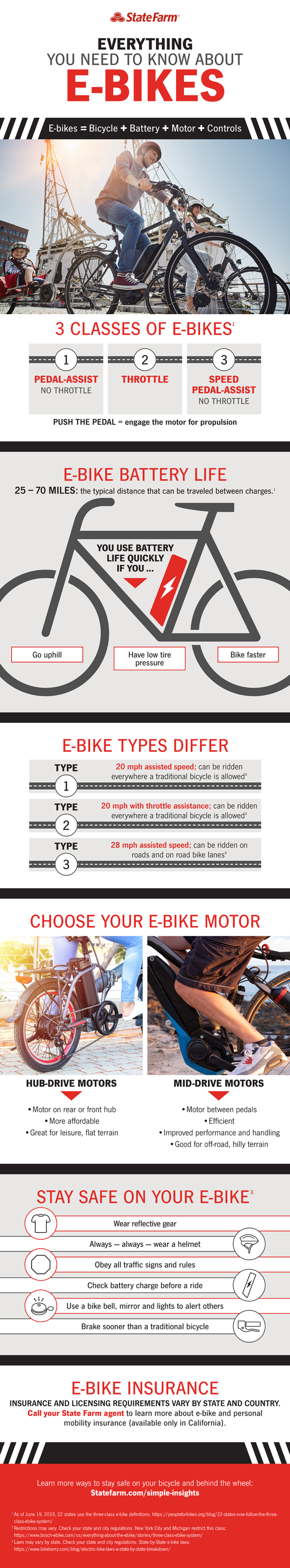

What Are E Bikes How To Stay Safe And Covered State Farm

Ebike News E Bike Tax Credits Back On Track New Schwinn And Gazelle E Bikes And Much More Electric Bike Report Electric Bike Ebikes Electric Bicycles E Bike Reviews

Ebike News E Bike Tax Credits Back On Track New Schwinn And Gazelle E Bikes And Much More Electric Bike Report Electric Bike Ebikes Electric Bicycles E Bike Reviews

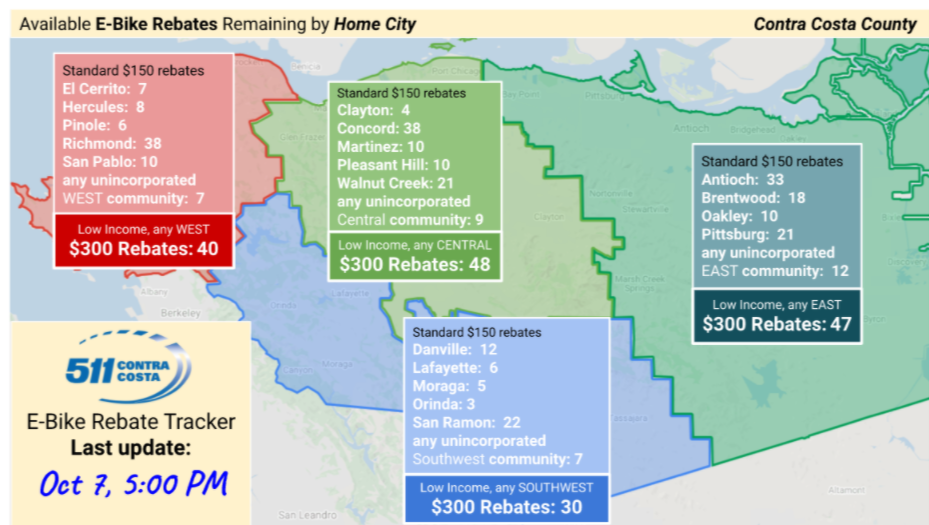

Mod Learning Center E Bike Rebate Pilot Program Contra Costa County Ca 2020

The Top 5 Biggest Micromobility Predictions For 2022

Tax Credits Jump To 1 500 For E Bikes 7 500 For Electric Motorcycles In Build Back Better Act R Motorcycles

Ebike News E Bike Tax Credits Back On Track New Schwinn And Gazelle E Bikes And Much More Electric Bike Report Electric Bike Ebikes Electric Bicycles E Bike Reviews

Tax Benefits On Loans For Electric Vehicles What Is The Real Tax Benefit Emi Calculator

Ebike News E Bike Tax Credits Back On Track New Schwinn And Gazelle E Bikes And Much More Electric Bike Report Electric Bike Ebikes Electric Bicycles E Bike Reviews

Ebike News E Bike Tax Credits Back On Track New Schwinn And Gazelle E Bikes And Much More Electric Bike Report Electric Bike Ebikes Electric Bicycles E Bike Reviews

Ebike News E Bike Tax Credits Back On Track New Schwinn And Gazelle E Bikes And Much More Electric Bike Report Electric Bike Ebikes Electric Bicycles E Bike Reviews

Lime Goes Back To E Bike Basics Greater Greater Washington

Aplusbuy Yescom Electric Bicycle Motor Kit 26 Rear Wheel 48v 1500w E Bike Conversion Kit

California Capitol Watch E Bike Incentive Bill Would Help Improve Air Quality And Physical Fitness Davis Vanguard

Ariel Rider Grizzly Review A Two Motor 3 700 Watt Moped Style Electric Bike

Aplusbuy Yescom Electric Bicycle Motor Kit 26 Rear Wheel 48v 1500w E Bike Conversion Kit

Ebike News E Bike Tax Credits Back On Track New Schwinn And Gazelle E Bikes And Much More Electric Bike Report Electric Bike Ebikes Electric Bicycles E Bike Reviews